The Costly Visual Search Blind Spot That Is Making Bangladesh Brands Invisible

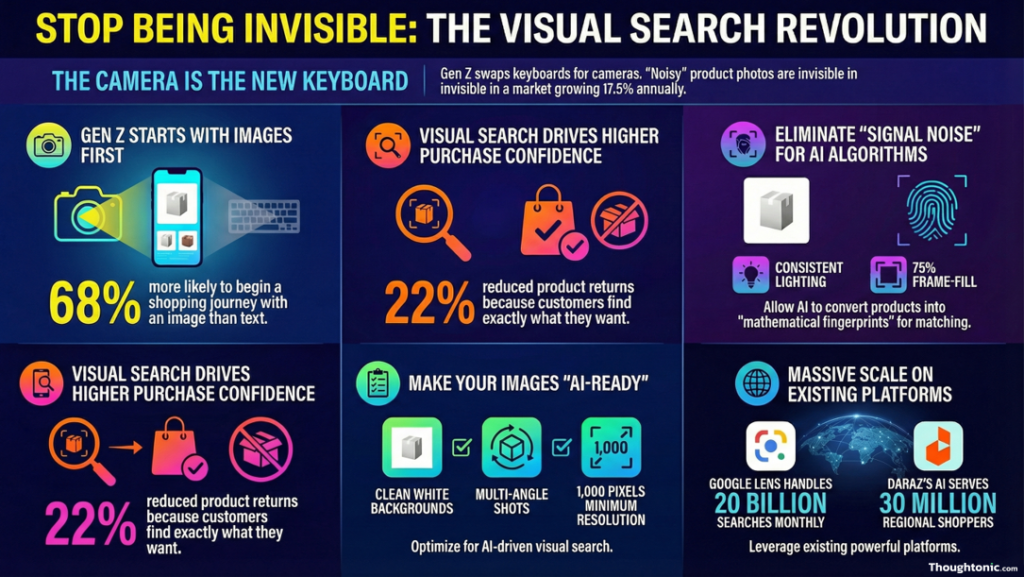

A Gen Z buyer sees a pair of shoes she likes on someone’s Instagram story. She does not type anything. She opens Google Lens, points it at the screen, and within two seconds she has a page of shoppable matches. That is visual search, and it is not a niche Western habit. Google Lens handles approximately 20 billion visual searches per month. Gen Z shoppers are 68% more likely than previous generations to begin a shopping journey with an image rather than text, according to research cited by Fortune in 2025. The global visual search market was valued at USD 41.72 billion in 2024 and is growing at 17.5% annually. The question for every brand operating in Bangladesh is simple: when a camera is pointed at your product category, do you appear?

Why Visual Search Is a Bangladesh Problem Right Now, Not Later

Bangladesh has every precondition for rapid visual search adoption. There are 130 million internet users in the country. 80% of e-commerce transactions happen on mobile. 67 million Facebook users run a F-commerce ecosystem of roughly 300,000 active sellers generating close to USD 1 billion annually. The broader e-commerce market hit USD 6.84 billion in 2024. And the majority of new internet users coming online are young, mobile-first, and visually oriented. What is missing is supply-side adaptation: brands and sellers optimizing their product imagery for camera-searchability.

Globally, 38% of retailers reported increased conversion rates in 2024 from image-driven search. Retailers using visual search also see up to a 22% reduction in product returns, because customers who find exactly what they searched for buy with more certainty. Meanwhile, 56% of Gen Z shoppers already use visual search for product discovery. Bangladesh’s F-commerce sellers are photographing products on kitchen counters with shifting natural light, a setup that builds warmth on a Facebook feed but creates noise for visual AI engines. That noise means invisibility. The brands that close this gap first will compound a structural discoverability advantage over every competitor that waits.

How Visual Search Actually Works: The Science Without the Jargon

Think of the Camera as the New Keyboard

When you type “red embroidered sari” into a search engine, it matches your words to words in its index. Visual search flips that. When you upload or photograph a product, the AI converts the image into a mathematical fingerprint, called a vector, capturing the product’s shape, color, texture, and pattern. That vector is compared against millions of similar vectors in the engine’s database, and the closest matches surface as results. The quality of what the AI returns depends entirely on the quality of what it has to work with. Product images with inconsistent backgrounds, poor lighting, or low resolution produce a noisy vector. Noisy vectors do not get matched confidently. Your competitor with clean, structured, multi-angle imagery wins the result. You are simply not seen.

Where Visual Search Happens in 2025

Google Lens dominates with roughly 20 billion monthly searches, approximately 4 billion of them shopping-related, and is embedded in every Android device. Pinterest Lens serves a fashion and lifestyle-driven audience where more than half the users are Gen Z. Amazon StyleSnap lets users upload outfit photos and find shoppable matches. TikTok is piloting image-based product search inside TikTok Shop. And Daraz, Bangladesh’s largest marketplace, launched AskDaraz in 2023, an AI chatbot built on Microsoft Azure OpenAI, serving 30 million South Asian shoppers. It is a conversational discovery tool today, but it is the infrastructure layer on which visual search will run tomorrow. The brands whose product content is AI-ready will win visibility first when Daraz eventually rolls out camera-based search.

In my analysis, the most overlooked opportunity for Bangladesh brands right now is Pinterest. The platform’s visual search engine indexes publicly available product images from anywhere in the world. A Bangladesh brand with a properly structured product catalogue can appear in Pinterest visual searches without ever maintaining a Pinterest presence. That is free, unclaimed discoverability that most local brands have not pursued.

What Camera-Searchable Product Images Actually Require

A camera-searchable product needs five things: a clean, neutral or white background so the AI isolates the product without interference; multi-angle coverage including front, back, side, and a detail close-up; a minimum resolution of 1,000 pixels on the shortest side; the product filling at least 75% of the frame; and consistent photography protocol across your entire catalogue. Consistency matters as much as quality. Inconsistency across your catalogue creates signal noise that makes the AI less confident in matching your products. One brand, one visual standard, applied without exception.

The CAMERA Framework: Six Steps to Becoming Camera-Searchable

- Catalog your current assets. Run your top 30 SKUs through Google Lens today. Document which products surface and which do not. This is your baseline. Most brands skip this step and assume they are indexed. Many are not.

- Align photography to AI indexability standards. Establish a brief that prioritizes machine readability: white or neutral backgrounds for primary images, multi-angle coverage, resolution minimums. Keep lifestyle shots for social content. Your e-commerce catalogue needs AI-standard imagery.

- Map where your customers visually search. Fashion buyers use Pinterest and TikTok. Electronics buyers use Google Lens and Amazon. Understand your category before deciding where to concentrate effort.

- Enrich product metadata to support visual context. Visual AI engines cross-reference image vectors with structured attributes: color codes, material tags, texture descriptors, style labels. A sari listed as “sari, silk, red, Jamdani motif” surfaces far more precisely than one listed as just “sari.”

- Run visual search tests consistently. Assign someone 30 minutes per week to test your top SKUs and track how results change. Make it someone’s explicit responsibility, not a task that falls between roles.

- Adapt based on what the algorithm rewards. Build a quarterly image review into your marketing calendar. Not a full reshoot, but a targeted update of the SKUs that are underperforming in visual search results.

Case Studies: What Getting This Right Looks Like

ASOS StyleMatch: The Global Benchmark

ASOS launched StyleMatch in 2017 and rolled it globally in 2018, allowing users to photograph anything and find matches within a catalogue of 85,000+ products. By launch, 80% of ASOS traffic was already on mobile and 70% of UK orders were placed via phone. Visual search was not a novelty. It was a response to how customers were already shopping. Within two months, ASOS reported strong engagement, with visual search users spending significantly more time in-app. The retailer subsequently credited aggressive technology investment, including StyleMatch, as a contributor to 34% sales growth in the first eight months of 2018. Zalando, a European peer that followed a similar path, reported an 18% lift in customer engagement after adding visual search. The limitation: ASOS never released conversion attribution numbers for StyleMatch alone. But the directional signal is clear. Early investment in visual discoverability compounds. The transferable lesson for Bangladesh brands is not the budget. It is the mindset: make image-indexed product content non-negotiable before the market fully demands it.

Daraz and the South Asian Discovery Shift

Daraz’s AskDaraz launch in 2023 is the most relevant regional data point. Built on GPT-4 architecture via Microsoft Azure, the tool allows shoppers to describe products conversationally and receive personalized recommendations, bypassing the friction of keyword search. For Bangladesh, where switching between Bangla and English creates real text search barriers, this matters. But here’s the thing: Daraz built the infrastructure. The sellers populating its catalogue have not caught up. Brands whose product listings carry clean imagery, rich metadata, and consistent visual assets will win algorithmic visibility first as Daraz’s AI matures. Anecdotally, shoppers in Bangladesh are already photographing saris at weddings and searching Google Lens for similar designs from local sellers. That behavior is organic and unprompted. The brands those shoppers find are making sales they do not even know they are winning. The brands they do not find are losing sales they do not know they are missing.

Action Plans: What to Do This Quarter

For Organizations

Weeks 1 to 2: Run a 30-SKU Google Lens and Pinterest Lens audit. It costs nothing but time. Weeks 3 to 4: Commission a reshoot of your top 20 revenue SKUs to AI-indexability standards. Budget: BDT 15,000 to 50,000 depending on product type. Month 2: Enrich your product metadata on Google Merchant Center and Daraz seller account with color, material, and style attributes. Free, high-impact, and almost nobody is doing it. Month 3 onward: Brief your social media team on visual-search-friendly content principles: consistent backgrounds, prominent product framing, brand color consistency. Assign one person to run monthly visual search tests and report results.

For Marketing Professionals

Most brand managers in Dhaka have never been briefed by a client to optimize for visual search. That does not mean the skill is not valuable. It means the person who builds it first shapes the strategy when the brief finally arrives. Spend two hours this week doing hands-on testing: photograph products, run them through Google Lens, and reverse-engineer what surfaces and why. Read the Google Merchant Center image requirements. Open a Pinterest Business account and explore its visual tools. The technical barrier here is low. The experiential barrier is the one most professionals have not cleared. Clear it now, before a competitor does. For CXOs and senior marketers: put visual search readiness on the next quarterly brand review as a standalone agenda item. The brands most visible to camera-searching consumers in 2027 are the ones whose leadership had this conversation in 2025.

Critical Perspective: Where This Advice Has Limits

Three honest caveats. First, connectivity is not uniform. Image-heavy visual search experiences work smoothly on 4G in Dhaka but can be slow and conversion-killing outside urban centres. Page performance optimization must run alongside visual search optimization for brands with mass-market reach. Second, the clinical studio shot that performs best in Google Lens is not always the relatable personal photo that builds buyer trust on Facebook Marketplace. Maintain both content streams for different functions. Third, and this is the risk nobody talks about: visual search makes it trivially easy for competitors to photograph and replicate winning product designs. In markets where IP enforcement is weak, a brand investing in highly visible, beautifully indexed products may be inadvertently handing a design roadmap to faster-moving copycats. Plan for this deliberately.

Key Takeaways

- The global visual search market was USD 41.72 billion in 2024, growing at 17.5% annually to USD 151.60 billion by 2032. This is a current market, not a forecast.

- Gen Z shoppers are 68% more likely to start a purchase journey with an image than text. Bangladesh’s mobile-first consumer base makes this urgently relevant now.

- Camera-searchability requires five things: clean background, multi-angle coverage, high resolution, product-filling framing, and catalogue-wide photography consistency.

- Daraz has AI discovery infrastructure live for 30 million South Asian shoppers. Brands with clean, metadata-rich product listings will win visibility as that system matures.

- A 30-SKU Google Lens audit takes under two hours and costs nothing. It is the fastest way to understand your current visual search positioning.

- Visual search optimization reduces returns by up to 22% because buyers who find exactly what they searched for purchase with higher confidence.

- The risk of inaction is structural invisibility. You lose the sale and never know you lost it.

Read more articles:

Quantum Marketing: How 2030’s Technologies Will Shatter Bangladesh’s Status QuoDigital Literacy & Brand Purpose: How Education Drives Loyalty in Emerging MarketsGenerative AI in Bangladeshi Advertising: Opportunities, Ethical Risks & Implementation Guide 2025The Brain’s Buy Button: How Neuromarketing Taps into Consumer Decision-Making (Global & Bangladesh Insights)Beyond the Bot: The Empathy Mandate for AI-Driven Customer Service in Bangladesh: A Data-Driven Roadmap

Bibliography

- Data Bridge Market Research – Global Visual Search Market Size, Share and Trends Analysis Report to 2032, 2024

- Fortune – Beyond the scroll: how visual search is redefining the future of retail, November 2025

- PCMI Payments Intelligence – Bangladesh E-commerce Market: Growth and Trends 2024-2025, January 2025

- Ecomezi – Future of E-Commerce in Bangladesh, October 2025

- The Daily Star – Daraz launches AskDaraz, an in-app discovery service, July 2023

- Future Startup – White Paper: The Future of E-commerce in Bangladesh, January 2025

- Globe Newswire – Bangladesh B2C Ecommerce Market Forecast Report 2025-2029, January 2026

- Nucamp – The Complete Guide to Using AI in the Retail Industry in Bangladesh in 2025, September 2025

- com – Mastering Visual Search for SEO in Bangladesh, February 2025

- Retail Dive – ASOS visual search drives great engagement, October 2017

- Imagga Blog – Visual Search and the New Rules of Retail Discovery in 2026, November 2025

- Imagga Blog – Visual Search in E-commerce: The Smartest Way to Turn Browsers into Buyers, July 2025

- Market Growth Reports – Visual Search Market Size and Forecast 2033, 2024

- SEO Sandwitch – Visual Search Stats: Unlocking the Future of Search Technology, November 2024

- Shopify Retail – What Is Visual Search? Definition, Examples and Tips for Retailers, 2024

- DHL Bangladesh – Bangladesh E-Commerce Trends in 2025

- Ngital – E-commerce in Bangladesh: Trends and Opportunities for Growth, April 2025