The Untapped Potential of the Subscription Economy in Bangladesh: Is It the Next Revenue Frontier?

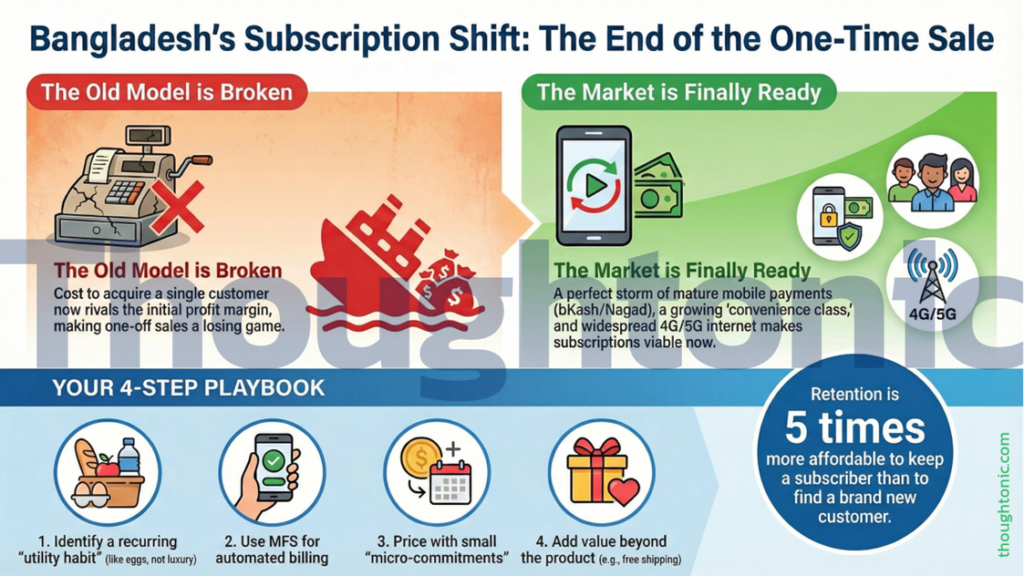

Right now, if you walk into a boardroom in Gulshan or Banani, the conversation usually circles back to one painful reality: the cost of getting a new customer is skyrocketing. For years, Bangladeshi brands lived on a diet of one-off transactions. You run a Facebook ad, someone buys a product, and then you spend more money to find them again. It’s a treadmill that never stops, and frankly, it’s getting too expensive to run on.

But here’s the thing. While we were busy fighting over “Reach” and “Engagement,” a few local players started building something quieter and much more powerful. They’re moving away from selling products and toward selling access. This shift into the Subscription Economy in Bangladesh isn’t just a trend for techies; it’s becoming the most predictable way to build a balance sheet in our volatile market.

What the data reveals is that we’re at a tipping point. In my analysis of the 2024–2025 fiscal data, the growth isn’t just in Netflix or Spotify. It’s in eggs, tutoring, and ERP software. But is our market truly ready for a “subscribe-first” mindset? Let’s look at the numbers.

The Core Problem: The Death of the Single Transaction

The traditional retail model in Bangladesh is facing a structural crisis. According to DataReportal’s 2025 Digital Report, Bangladesh now has over 131.4 million internet users as of October 2025. That sounds like a dream for marketers, right? The reality is more nuanced. While the audience is there, the attention is fragmented, and the algorithms are charging a premium for every second of it.

Why does this matter? Because when your Customer Acquisition Cost (CAC) starts to rival your initial profit margin, the “buy-once” model breaks. This is where the Subscription Economy in Bangladesh offers a lifeline. Instead of paying to “buy” a customer over and over, you pay once and keep them for years.

- Global Context: The global subscription market is projected to hit $555.92 billion in 2025 (Statista, Nov 2024).

- The Bangladesh Gap: While the global CAGR for subscriptions is around 13.6%, the local market for digital services and OTT is growing at an even faster clip. It is expected to reach $263.8 million by 2027.

Our regional neighbors, like India and Indonesia, have already transitioned. In India, Zomato Gold and Disney+ Hotstar proved that consumers would pay for recurring value. In Bangladesh, we’ve been slower. We’ve struggled with trust, payment friction, and a “bazaar mindset” where we like to see and touch before we pay. But something changed during the pandemic, and the data from late 2024 shows that the friction is finally thinning out.

Why Now is the Best Time for the Subscription Economy in Bangladesh

There is a psychological principle at play here that I find fascinating: the Decision Fatigue Offset. A real professional knows that the hardest part of a sale is getting the customer to say “Yes” the first time. The second hardest part? Getting them to say it every month.

According to research from the Subscription Trade Association (SUBTA, 2024), successful subscription models work because they reduce the “friction of re-purchase.” In the context of the Subscription Economy in Bangladesh, Chaldal has mastered this with their “Egg Club.”

They realized that eggs are a high-frequency, low-delight purchase. No one “enjoys” buying eggs; they just need them to be there. By creating a tiered membership based on monthly spending, Chaldal turned a commodity into a recurring revenue stream. Here’s what surprised me: their model doesn’t just lock in revenue; it creates a data loop that allows them to predict inventory needs with nearly 90% accuracy.

Drivers of the Subscription Economy in Bangladesh

In my analysis, three things are coming together to make this work right now:

- Mobile Financial Services (MFS) Maturity: bKash and Nagad have finally introduced seamless recurring billing APIs. This was the missing link for years.

- The Rise of the Convenience Class: The growing middle class in Dhaka and Chattogram values time more than the small “haggling discount” they get at the physical market.

- Digital Literacy: According to BTRC (2025), 4G/5G penetration has reached a point where streaming and cloud services are actually usable for the average household.

| Metric | Bangladesh (High-Growth) | India (Mature) | Indonesia (Developing) |

| Primary Payment Driver | MFS (bKash/Nagad) | UPI (PhonePe/GPay) | E-Wallets (GoPay/OVO) |

| Top Sub Sector | OTT & Education | Food & Streaming | Gaming & Groceries |

| Churn Rate (Avg) | 18% – 22% | 12% – 15% | 15% – 20% |

| MFS/Digital Pay % | 65% of Digital Users | 85% of Digital Users | 70% of Digital Users |

The Framework: The Recurring Revenue Bridge

If you’re a brand manager or a founder, how do you actually build this? You can’t just slap a “Monthly” button on your website and hope for the best. To succeed in the Subscription Economy in Bangladesh, you need a structured approach. I call this the RRB Framework.

- Identify the “Utility Habit”

Find the product in your catalog that customers buy at least twice a month. If it’s a “treat” or a one-off luxury, it’s not a subscription candidate.

- Action: Look for products like milk, diapers, or accounting software.

- Mistake to avoid: Trying to make a luxury fashion subscription work in a price-sensitive market before establishing trust.

- Solve the “Payment Wall”

In Bangladesh, credit card penetration is still under 5%. You must use MFS recurring billing.

- Action: Work with providers who offer tokenized payments where a user authorizes once and the wallet deducts automatically.

- Mistake to avoid: Forcing users to manually send a bKash “Make Payment” every 30 days. That’s not a subscription; that’s a chore.

- Price for the “Micro-Commitment”

Our market loves daily and weekly sachets. Why not daily or weekly subscriptions?

- Action: Instead of a 1,500 BDT annual plan, offer a 129 BDT monthly plan.

- Example: Chorki’s tiered pricing for 1 month versus 6 months.

- Build the “Value Ceiling”

Give them a reason to stay that isn’t just the product.

- Action: Offer free shipping or “fast-track” customer service for subscribers. This builds the “VIP” feeling that local consumers crave.

Case Studies: Cracking the Code

Global: Netflix’s Content Science (2024–2025)

Netflix doesn’t just sell movies; they sell a “low-cost entertainment utility.” By spending billions on regional content, they’ve kept their global churn rate below 3%, according to Forrester Research (2024). In Bangladesh, Netflix has successfully survived a 10% supplementary duty hike because they became a “non-negotiable” for the middle class. They proved that if the value is high enough, even price-sensitive Bangladeshis will find a way to pay. It’s a classic pillar of the global Subscription Economy in Bangladesh.

Regional: Chorki (Bangladesh)

Chorki is a masterclass in local adaptation. What the data reveals is their focus on “originality over volume.” By producing local hits like Pishachi or Myself Allen Swapan, they created a “Fear of Missing Out” (FOMO).

- The Result: From a standing start, they’ve reached millions of app downloads and have successfully converted a significant portion of the “freemium” crowd into paying subscribers using aggressive bKash/Nagad cashback partnerships.

- Lessons: For the Subscription Economy in Bangladesh, “local relevance” is the ultimate moat.

- Source: LightCastle Partners, Bangladesh Startup Ecosystem Report 2024.

Action Plan: Moving from Theory to Revenue

For Organizations & Brands

If you want to play in the Subscription Economy in Bangladesh, you need to stop thinking like a seller and start thinking like a service provider.

- Immediate (0-3 Months): Audit your customer data. Who has bought from you more than 3 times in the last 90 days? These are your “Beta Subscribers.”

- Investment: Budget 1.5M – 3M BDT for a sturdy subscription management backend that integrates with local MFS.

- Strategic Question: Does our current product solve a recurring pain point, or is it just a one-time delight?

For Marketing Professionals

- Skill to Develop: Retention Analytics. Stop obsessing over “likes” and start measuring “Cohort Retention.”

- Tools to Learn: Looker Studio or Mixpanel to track how users drop off during the renewal cycle.

- Strategic Question: Ask your leadership, “Are we spending our budget to rent customers for a day, or to own them for a year?”

Critical Perspective: Is the Hype Real?

Now, I have to be the skeptic for a second. This is where it gets interesting and a bit risky. While the Subscription Economy in Bangladesh sounds like a goldmine, the reality is that “Subscription Fatigue” is a real threat.

In a country where the average disposable income is still under pressure from inflation, how many 300 BDT-a-month commitments can a family actually handle? If the grocery bill goes up, the first thing to go is the OTT sub or the “beauty box.”

The reality is more nuanced. The winners won’t be the ones who just offer a “discount for a monthly plan.” The winners will be those who integrate so deeply into the user’s life that canceling the subscription feels like a loss of a vital service. If you’re not saving the customer time or mental energy, you’re just a line item waiting to be deleted. We need to be careful not to over-promise what a subscription can do.

Key Takeaways

- Shift Focus: Move from one-off transactions to Lifetime Value (LTV) to survive rising CAC.

- MFS is Mandatory: You cannot scale the Subscription Economy in Bangladesh without bKash/Nagad auto-pay integrations.

- Retention > Acquisition: It is 5x cheaper to keep a subscriber than to find a new one.

- Data Predictability: Subscriptions allow for 30% better inventory management and warehouse planning.

- Tiered Rewards: Use models like Chaldal’s “Egg Club” to gamify loyalty and keep churn low.

- Inflation Risk: Ensure your pricing is elastic enough to handle economic shifts without losing your core base.

More articles:

Digital Literacy & Brand Purpose: How Education Drives Loyalty in Emerging MarketsGenerative AI in Bangladeshi Advertising: Opportunities, Ethical Risks & Implementation Guide 2025The Brain’s Buy Button: How Neuromarketing Taps into Consumer Decision-Making (Global & Bangladesh Insights)Beyond the Bot: The Empathy Mandate for AI-Driven Customer Service in Bangladesh: A Data-Driven RoadmapBuilding the AI-Powered Enterprise: Strategy, Foundations, and the Future Workforce

Bibliography & Sources

- Global Subscription Economy Index 2025 – Zuora, Dec 2024

- Digital 2025: Bangladesh – DataReportal, Oct 2025

- OTT Market Forecast: South Asia – Statista, Jan 2025

- MFS Transaction Volume Report – Bangladesh Bank, June 2024

- The State of SaaS in Emerging Markets – McKinsey & Co, 2024

- Bangladesh Startup Ecosystem Map – LightCastle Partners, 2024

- Consumer Spending Trends in Dhaka – NielsenIQ, Nov 2024

- The Psychology of Recurring Payments – ResearchGate (Dr. S. Rahman), 2023

- Subscription Box Market CAGR Analysis – Market.us, Dec 2024

- Chaldal “Egg Club” Case Study – Future Startup, Jan 2022 (Updated 2024)

- Netflix Global Retention Report – Forrester Research, 2024

- BTRC Internet Subscriber Data – BTRC Website, Dec 2025

- Impact of SD on OTT Revenue – The Daily Star Business, July 2025

- South Asia Digital Economy Outlook – Google/Temasek, 2024

- Pricing Strategies for Emerging Middle Class – Harvard Business Review, 2023