The Brutal Truth About Sustainable Fintech Branding in Bangladesh

Is your user loyalty real, or did you just buy it for 20 Taka? Here is the math behind why cashbacks are a ticking time bomb for Bangladeshi brands.

The most dangerous drug in the Bangladeshi startup ecosystem isn’t cheap capital or hype. It’s the “20 Taka Cashback.” For the last five years, we have trained an entire generation of digital natives to believe that the act of paying for something should reward them. We have confused transaction volume with loyalty. We have confused discount hunters with customers. But here’s the thing about loyalty bought with subsidies: it has a half-life of exactly zero seconds. The moment the discount stops, the “loyalty” evaporates. This brings us to the most critical challenge facing our industry today: building sustainable fintech branding that survives when the venture capital tap runs dry.

It is a harsh reality. If your users only love you for the discount, they will leave you for the next startup that raises a seed round.

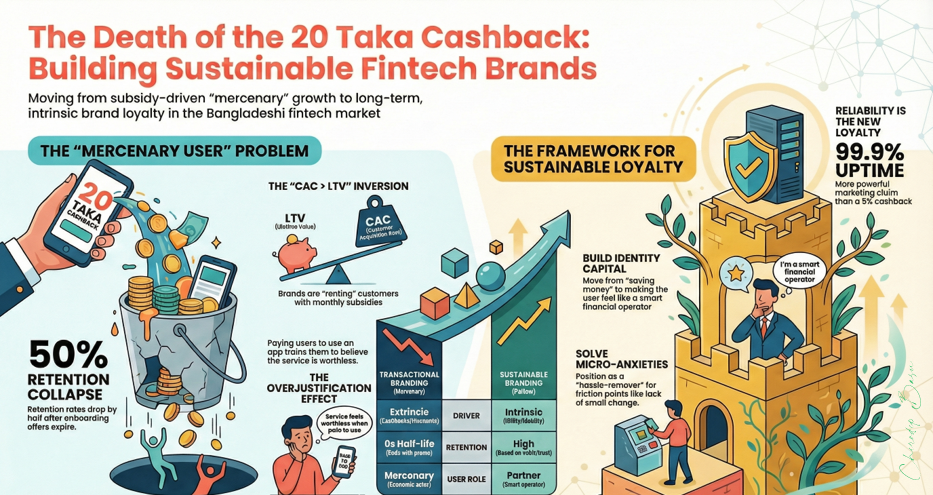

The “Mercenary User” Problem

Let’s look at the numbers. In the high-growth phase of Bangladeshi fintech, we often celebrate Monthly Active Users (MAUs) like they are a trophy. But if you strip away the users who only transacted because of a promo code, what is left?

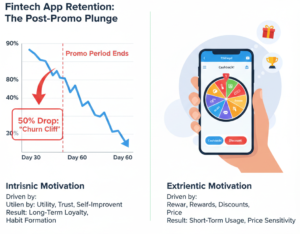

In my analysis of market data, the retention rate for finance apps in aggressive markets often drops by nearly 50% after day 30 once onboarding offers expire. That is not a leaky bucket. That is a bucket with no bottom. The Bangladeshi consumer is smart. They are arguably the most rational economic actors on the planet. If Brand A offers a 10% discount and Brand B offers 12%, the user switches. This isn’t betrayal. It is basic math.

This creates a dangerous dynamic I call the “CAC > LTV Inversion.” In a healthy business, the Lifetime Value (LTV) of a customer should be 3x their Customer Acquisition Cost (CAC). But for many wallets in Dhaka, the CAC is effectively a recurring cost. You aren’t “acquiring” the customer; you are renting them. You pay them 20 Taka every month to stay. The moment you stop paying rent, they move out.

The Science of Transactional vs. Emotional Loyalty

Why does this happen? It comes down to how the human brain processes value.

When you lead with sustainable fintech branding, you are appealing to intrinsic motivation. This is the user’s internal desire for safety, status, or ease. When you lead with cashbacks, you trigger extrinsic motivation.

Behavioral economists have long studied the “Overjustification Effect.” This effect predicts that if you start paying people to do something they might have done for free, like using a convenient app, they eventually lose interest in the activity itself. They only care about the payment.

Total Motivation = Intrinsic (Utility) + Extrinsic (Reward)

When the Extrinsic reward drops to zero, the Total Motivation collapses below the threshold of action. You have effectively trained your user to devalue your product. You taught them that your service is not worth paying for. In fact, you taught them it is so worthless that you must pay them to use it.

A Framework for Breaking the Addiction

So, how do we pivot? How do we build sustainable fintech branding in a market obsessed with deals? We need to move up the hierarchy of value.

Solve Micro-Anxieties, Not Just Price

The biggest competitor to digital payments in Bangladesh isn’t another bank. It’s cash. Cash is anonymous, instant, and accepted everywhere. To beat it, you cannot just be cheaper. You have to be better.

- The Shift: Identify the friction points of cash. It’s not the cost; it’s the lack of change ( খুচরা taka), the dirty notes, or the difficulty of tracking spending.

- The Action: Position your brand as the “hassle-remover,” not the “money-giver.”

- Example: A user uses an app for rickshaw payments not because of a discount, but because they hate arguing over 2 Taka change. That is a sustainable hook.

Build Identity Capital

People allow brands to define who they are. Apple makes you feel creative. Nike makes you feel athletic. What does your fintech brand make the user feel?

- The Shift: Move from “We save you money” to “We make you a modern, smart financial operator.”

- The Action: Design the UI and the copy to make the user feel in control. The “Green Checkmark” of a successful transfer should release as much dopamine as a Facebook like.

- The Mistake: Using generic corporate speak. Talk like a human.

Create Network Utility

This is the holy grail. Your product should become more valuable to me when my friends use it.

- The Shift: Incentivize peer-to-peer behaviors, not just merchant payments.

- The Action: Features like bill-splitting or “request money” create social obligations that keep users on the platform. You can’t switch apps if your whole office group uses Brand X for lunch splitting.

Become the Advisor, Not the Wallet

Wallets are empty vessels. Advisors are trusted partners.

- The Shift: Show users data about their spending. Give them insights.

- The Action: If you tell a user, “You spent 5,000 Taka on coffee this month, here is how to cut back,” you earn trust. You become the app they check to feel organized, not just to pay.

Case Studies: Utility vs. Bribery

Global Benchmark: Nubank (Brazil)

Nubank is the gold standard for sustainable fintech branding. In Brazil, they faced a banking oligopoly notorious for high fees and terrible service. Nubank didn’t launch with massive cashbacks. They launched with a purple card, a beautiful app, and human customer service.

- The Outcome: They grew to 40 million customers largely through word-of-mouth. Their brand promise was “dignity” and “freedom,” not “free money.” When they do offer rewards, it is a cherry on top, not the whole cake.

Local Reality: bKash (The Early Years)

Look back at the early days of bKash. Their initial explosion wasn’t driven by 50% discounts on burgers. It was driven by a powerful emotional narrative: sending money home to the village. The “utility” was the ability to support family instantly.

- The Lesson: The brand became a verb (“bKash koro”) because it solved a massive logistical problem. The connection was emotional and functional. The challenge they face now, and it is a significant one, is maintaining that premium status as competitors drag the market into a price war.

Action Plan: 90 Days to Detox

For organizations and professionals ready to stop the bleeding, here is the roadmap.

For The Organization (The Strategy)

- Month 1: The Audit. Separate your user base. Tag users who only transact with a promo code. Calculate your “True Retention” excluding these mercenaries. It will be a painful number to look at.

- Month 2: The Service Surge. Take 20% of your promo budget and redirect it to Customer Experience (CX). Reduce ticket resolution time by half. Fix the bugs that annoy people. Reliability is the new loyalty.

- Month 3: The Narrative Shift. Launch a campaign that highlights a feature, not a price. “Pay in 3 seconds,” “Never fail,” or “Track your wealth.”

For The Professional (The Skills)

- Learn Unit Economics: Stop presenting vanity metrics to your board. If you can’t explain the path to LTV > CAC without subsidies, you aren’t a strategist. You’re a spender.

- Study Behavioral Psychology: Read Kahneman. Understand “Loss Aversion” and “Sunk Cost Fallacy.” Use these to build product hooks that stick harder than money.

- Write Like a Human: Stop saying “seamless digital payment solutions.” Say “Pay without the headache.”

Critical Perspective: The Risk of Withdrawal

I need to be realistic here. The “cold turkey” approach has risks. In a market like Dhaka, where competitors are still burning cash to grab market share, stopping discounts entirely can lead to a rapid drop in daily active users.

There is a scenario where “doing less” is dangerous if your product isn’t actually superior. If your app is slow, buggy, and has bad UX, the discount was the only thing keeping you alive. Sustainable fintech branding only works if the underlying product is solid. You cannot brand your way out of a bad product.

We must also acknowledge the economic reality of our users. Inflation is high. A 20 Taka saving matters. The goal isn’t to eliminate rewards, but to make them unpredictable (variable rewards) rather than entitled (fixed expectation).

Key Takeaways

- Bribery isn’t Loyalty: If you have to pay them to stay, they are already gone.

- The Math Matters: When CAC becomes a recurring rental cost, your business model is broken.

- Solve for Friction: Be the fastest, easiest way to pay. Convenience beats cash. Discounts just compete with it.

- Invest in Identity: Give users a feeling of status or control, not just a coupon.

- Network Effects: Lock users in through their social circles, not their wallets.

- Retention over Acquisition: A user saved is worth five users bought.

- Reliability is King: In 2025, 99.9% uptime is a better marketing claim than 5% cashback.

Read More Articles:

Quantum Marketing: How 2030’s Technologies Will Shatter Bangladesh’s Status QuoDigital Literacy & Brand Purpose: How Education Drives Loyalty in Emerging MarketsGenerative AI in Bangladeshi Advertising: Opportunities, Ethical Risks & Implementation Guide 2025The Brain’s Buy Button: How Neuromarketing Taps into Consumer Decision-Making (Global & Bangladesh Insights)Beyond the Bot: The Empathy Mandate for AI-Driven Customer Service in Bangladesh: A Data-Driven Roadmap

Bibliography

- Adjust. (2024). Mobile App Trends 2024: A focus on Fintech. Adjust Reports.

- Google & Temasek. (2023). e-Conomy SEA 2023. Google Reports.

- Kahneman, D. (2011). Thinking, Fast and Slow. Farrar, Straus and Giroux.

- LightCastle Partners. (2023). Bangladesh Startup Ecosystem: The 2023 Review. LightCastle Analytics.

- Nubank. (2021). Form F-1 Registration Statement. US SEC.

- AppsFlyer. (2024). The State of Finance App Marketing. AppsFlyer.

- World Bank. (2022). The Global Findex Database 2021. World Bank Group.

- Hallowell, R. (1996). The relationships of customer satisfaction, customer loyalty, and profitability. Harvard Business School.

- Nielsen Norman Group. (2023). Trust in Digital Interfaces. NN/g.

- Thaler, R. (2008). Nudge: Improving Decisions About Health, Wealth, and Happiness. Yale University Press.

- WhiteBoard Magazine. (2023). The Future of MFS in Bangladesh. WhiteBoard.

- Bain & Company. (2023). Customer Loyalty in Retail Banking. Bain Insights.

- Harvard Business Review. (2022). Stop Trying to Delight Your Customers. HBR.org.

- McKinsey & Company. (2023). Fintech in Africa and South Asia: The end of the beginning. McKinsey.

- Daily Star. (2024). The Cashback Trap: Are we building a sustainable ecosystem?. The Daily Star Business.