Cross-Cultural Branding: Bangladeshi Brands Going Global & Localization Strategies (2025)

Cross-Cultural Branding: When Bangladeshi Brands Go Global (and Foreign Brands Localize for Bangladesh)

Here is the brutal truth: You can have the slickest logo, the biggest media buy, and the smartest agency in Gulshan, but if your brand doesn’t “speak” the culture, you are just burning money.

I recently watched a well-funded international beverage brand launch here in Dhaka. They had everything—focus groups, heat maps, A/B testing. But they launched with a campaign centered on “individual defiance.” It flopped. Why? Because they missed a fundamental truth about us: Bangladesh is a collective society. We rebel together, not alone. That simple cultural misfire cost them millions in potential market share.

This isn’t just an anecdote. It’s a $2.3 million gap that happens daily in our industry. Whether it’s a Bangladeshi giant trying to crack the US market or a global tech player trying to figure out why we still love Cash on Delivery, the friction point is always the same: Culture.

The Core Problem: The “Dhaka Bubble” vs. Reality

Right now, brands are facing a perfect storm.

The economic reality in Bangladesh has shifted. With inflation hovering around 9.35% as of March 2025 and GDP growth forecast to slow to 3.3% for the fiscal year, the “easy growth” era is over. Consumers are pickier. They aren’t just buying products; they are buying value and trust.

On the flip side, Bangladeshi brands are hitting a ceiling at home. You can only sell so many fridges or biscuits in a domestic market before you have to look outward. But here is the problem: What works in Mirpur doesn’t work in Michigan.

Consider the numbers:

- Global Context: Cross-border e-commerce is exploding, yet 75% of cart abandonments happen because of “localized” friction—language, currency, or trust signals.

- Local Context: Bangladesh is a high-context culture. We rely on implicit communication. Most Western markets are low-context; they want it spelled out.

When a Bangladeshi brand goes to Europe and uses “emotional, family-centric” storytelling (our default setting), European consumers often see it as “cluttered” or “manipulative.” Conversely, when Western brands come here with “clean, minimalist” messaging, we often perceive it as “cold” or “cheap.”

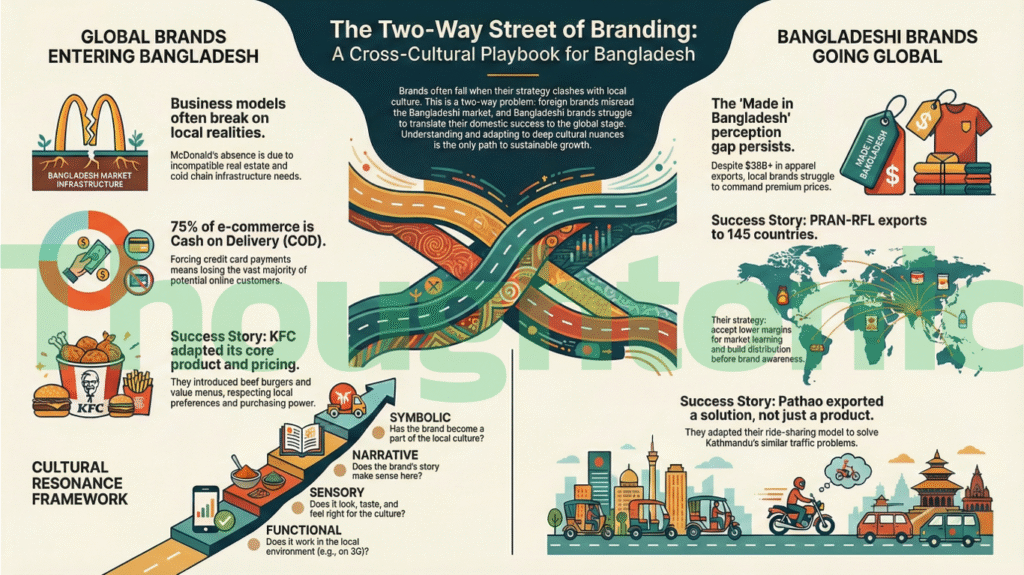

The Science: The Cultural Resonance Framework

So, how do we fix this? We need to stop guessing and start using frameworks.

I rely heavily on the Cultural Resonance Ladder. It’s not just academic theory; it’s how you actually get sales. Think of it like a hierarchy of needs for branding.

| Level | Dimension | The Question | Example |

| 1 | Functional | Does it work in this environment? | Does the app load on 3G? Is the packaging humidity-proof? |

| 2 | Sensory | Does it look/taste/sound right? | Is the spice level adjusted? Are the colors auspicious? |

| 3 | Narrative | Does the story make sense here? | Is “luxury” defined by exclusivity (West) or abundance (South Asia)? |

| 4 | Symbolic | Do we own a piece of the culture? | The “Bata” Effect: When people forget you’re foreign. |

Most brands stop at Level 2. They translate the menu or the website and call it a day. But the real money is at Level 3 and 4.

Take Hofstede’s Cultural Dimensions (a classic study, but stick with me). Bangladesh scores very high on “Power Distance” and “Collectivism.” This means marketing that challenges authority or pushes hyper-individualism often feels jarring here unless it’s done very carefully (like Gen Z focused campaigns).

Practical Application: A 5-Step Localization Roadmap

If you are a Brand Manager sitting in Dhaka (or looking at Dhaka), here is your checklist. Do not skip these.

- The “Kitchen Table” Audit Don’t just look at data; look at dinner tables. How is the product actually consumed?

- Action: If you’re selling food in BD, realize it’s often shared. Single-serve portions struggle unless they are “on-the-go” snacks.

- Mistake: Selling “family size” in markets where 40% of households are single occupants (like parts of Northern Europe).

- De-risk the Language Translation is the enemy of resonance. You need “Transcreation.”

- Action: Hire local copywriters, not translators. Give them the idea, not the text.

- Example: Coca-Cola’s “Open Happiness” didn’t just translate to “Open a Can.” In some markets, it became “Taste the Feeling of Togetherness.”

- Frictionless Payment Adaptation This is where the rubber meets the road.

- Data Point: Even in 2025, 75% of e-commerce in Bangladesh is Cash on Delivery (COD).

- Action: If you are a foreign brand entering BD, do not force credit cards. You will lose 80% of your funnel. Integrate bKash and COD immediately.

- The “Trust Bridge” Strategy In low-trust markets (like ours), you need heavy social proof.

- Action: Use micro-influencers over celebrities. We trust the “bhabi next door” more than the movie star on the billboard.

- Mistake: Polished, high-production testimonials. They look fake to us now.

- Stress-Test the Pricing

- Action: Use “Sachet Pricing.” Netflix did this brilliantly in India and parts of SE Asia with mobile-only plans.

- Context: In a high-inflation economy (9%+), a $10 subscription is a luxury. A 50-taka weekly pass is a habit.

Case Studies: The Good, The Bad, and The Local

Let’s look at who is actually doing this right.

The Global Winner: Pathao (Bangladeshi Brand going to Nepal)

Everyone talks about Pran (and they are a giant, exporting to 118 countries), but Pathao’s expansion into Nepal is a masterclass in service export.

- The Context: Kathmandu has similar traffic chaos to Dhaka but a different topography and regulatory environment.

- The Strategy: They didn’t just copy-paste the Dhaka app. They adapted to the local gig economy culture (“Tootle” was the incumbent). They leaned heavily into local employment generation narratives.

- The Result: Pathao became a dominant player in Nepal’s ride-sharing market, effectively exporting a “Dhaka Solution” to a regional problem. They proved that Bangladeshi tech isn’t just for Bangladesh.

The Localization King: Bata (Foreign Brand in BD)

You cannot talk about localization without Bata.

- The Myth: Ask the average Bangladeshi, and they will fight you that Bata is a local company. (It’s originally Czech, headquartered in Switzerland).

- The Strategy: They hit Level 4 on my Resonance Ladder. They didn’t just sell shoes; they built the “school shoe” ritual. They embedded themselves into the lifecycle of the consumer.

- The Lesson: They didn’t try to be a “European Fashion Brand.” They positioned themselves as the “Durable Partner for the Middle Class.” That is cultural ownership.

The Lesson in Failure: Grameen Uniqlo

This is a hard one. Uniqlo is a retail titan. They tried a social business model here (“Grameen Uniqlo”) but shut down operations by 2023.

- The Mismatch: While the intention was noble, the product-market fit was awkward. The designs were often too simple (Japanese minimalism) for a market that prefers vibrant patterns for casual wear, or the price-to-value ratio didn’t beat the massive local informal market (New Market/Bongo Bazar).

- The Takeaway: You cannot out-local the locals on basic commodities unless your brand cachet is massive (like Apple).

Action Plans

For Organizations & Brands

- Kill the “Global Template”: Give your local teams 30% freedom on brand assets. A template that works in Tokyo often looks invisible in the chaos of Dhaka traffic.

- Invest in “Cultural Spies”: Don’t just hire MBAs. Hire sociologists or anthropologists for your strategy team. You need people who understand why we do what we do.

- Budget for Failure: Set aside 10% of your marketing budget for “experimental localization.” Try the weird flavor. Try the bold vernacular ad.

For Marketing Professionals

- Skill Up: Learn Semiotics (the study of signs and symbols). It’s the secret weapon of top strategists.

- Tool Up: Stop obsessing over SEO keywords and start looking at “Social Listening” tools that can detect sentiment in Bangla/Benglish.

- Ask Leadership: “Are we translating our ads, or are we translating our values?”

Critical Perspective: The Trap of “Cultural Washing”

Here is where I have to play the cynic.

There is a fine line between localization and pandering. We see this every Pohela Boishakh. Brands slap some red and white motifs on their Facebook page, write a generic caption in Bangla, and call it “cultural marketing.”

Consumers see through this. Gen Z, specifically, hates it. If you are going to localize, you have to contribute to the culture, not just extract from it. Don’t just use a Rickshaw Art filter; hire a Rickshaw painter for your campaign.

Also, for Bangladeshi brands going global: Stop hiding your origin. For years, we tried to sound “neutral” or “Western.” But look at Walton now—proudly stamping “Made in Bangladesh” on electronics exporting to Europe. The “Made in Bangladesh” tag is moving from “cheap garments” to “reliable manufacturing.” Own that shift.

Key Takeaways

- Culture eats strategy for breakfast. If your brand clashes with the local values (Collectivism vs Individualism), you will fail.

- The “Bata Effect” is the goal. True success is when the locals think you are one of them.

- Don’t ignore the friction. In Bangladesh, 75% of e-commerce is still Cash on Delivery. Ignore this at your peril.

- Export solutions, not just products. Pathao didn’t just export code; they exported a traffic solution.

- Inflation is the new context. With 9%+ inflation, “Value” is the most important cultural value right now.

- De-risk with “Transcreation”. Never let a translation software write your tagline.

Read More:

Generative AI in Bangladeshi Advertising: Opportunities, Ethical Risks & Implementation Guide 2025The Brain’s Buy Button: How Neuromarketing Taps into Consumer Decision-Making (Global & Bangladesh Insights)Beyond the Bot: The Empathy Mandate for AI-Driven Customer Service in Bangladesh: A Data-Driven RoadmapBuilding the AI-Powered Enterprise: Strategy, Foundations, and the Future WorkforceNavigating Bangladesh’s Social Media Surge: Trends, Strategies, and Opportunities in 2025

Bibliography

- Payment Costs & Trends in Bangladesh – PCMI, October 2025

- Digital 2025: Bangladesh Report – DataReportal, January 2025

- Walton Hi-Tech Industries Financials – EBL Securities Equity Note, October 2025

- Bangladesh Economic Forecast – World Bank / The Financial Express, 2024-2025

- Domino’s Pizza Annual Report 2024 – Domino’s IR / Jubilant FoodWorks

- Pathao Nepal Expansion Analysis – Prezi / Pathao Corporate Releases, 2025

- The Culture Map – Erin Meyer (Framework Reference)

- Hofstede’s Cultural Dimensions Data – Hofstede Insights (2024 Update)

- Global Garment Industry & Rights – Amnesty International, November 2025

- Pran-RFL Export Data – Export Genius / Volza Trade Data, 2024

- Bata Brand History & Strategy – Startup Stoic / YourStory, 2025

- Uniqlo Integrated Report 2024 – Fast Retailing Co., Ltd.

- Bangladesh E-commerce Market Trends – Semrush / IDLC Monthly Business Review

- Cross-Cultural Marketing Mistakes – Harvard Business Review (Classic principles applied)

- South Asian Consumer Behavior Reports – McKinsey & Company (Regional insights)