The Unfolding Landscape: A Holistic View of Bangladesh’s Insurance Industry

Bridging Risk and Opportunity in a Dynamic Economy

The insurance industry is a vital economic pillar, providing financial protection to households and businesses while reducing government burdens during crises and fostering economic growth through strategic investments. A robust insurance sector contributes significantly to GDP, minimizes uninsured losses, reduces unemployment, and attracts foreign direct investment.

Despite its global importance and Bangladesh’s economic progress, the nation’s insurance sector remains largely underdeveloped with vast untapped potential. It faces historical challenges but is also poised for transformative growth. This report offers a comprehensive analysis of Bangladesh’s insurance landscape, examining its current state, strengths, weaknesses, market dynamics, and future trajectory.

Current Landscape and Categorization: A Sector in Evolution

Evolution and Structure

Bangladesh’s modern insurance industry began in 1972 with the nationalization of 49 entities under five state-owned corporations. Post-1990 reforms allowed private insurers to reinsure 50% of their business, leading to significant private sector growth and an 88% market share by 2004.

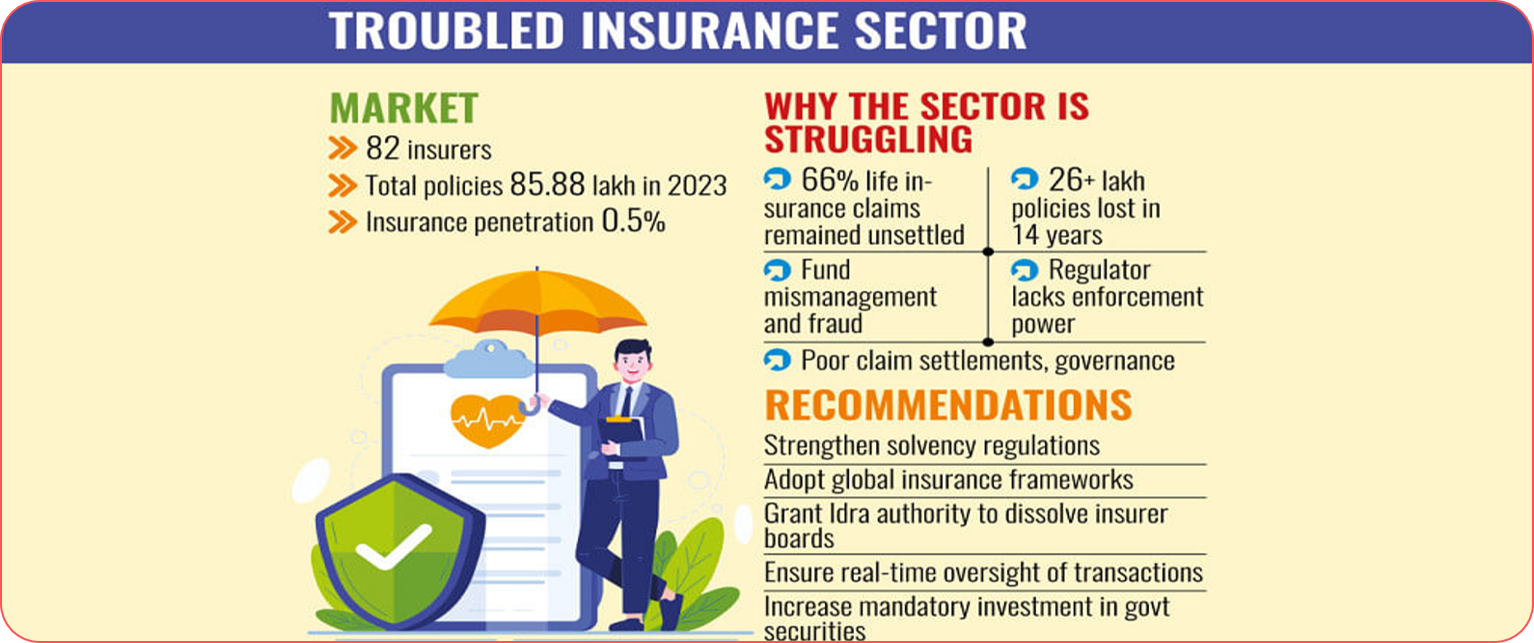

Currently, Bangladesh has 81 to 82 insurance companies: 35 to 36 life insurance firms and 44 to 46 non-life (general) insurance entities. These collectively cover approximately 18.97 million individuals.

The market is notably dominated by life insurance, holding 70.03% of the market share in 2019, compared to 29.97% for non-life insurance. This contrasts with global trends where non-life insurance typically has a larger share but aligns with other Asian markets like India. This imbalance suggests a cultural preference for life insurance and a significant underdevelopment of the non-life sector, despite Bangladesh’s high vulnerability to natural disasters and agricultural shocks. This leaves individuals, businesses, and the government exposed to substantial uninsured losses, hindering resilience and stability.

Key Players and Financial Health

In life insurance (2022/2024 data), MetLife leads with 27.10% market share, followed by National Life Insurance (14.10%), Delta Life Insurance (7.43%), Jiban Bima Corporation (6.69%), and Popular Life Insurance (5.93%). MetLife also holds the largest assets at Tk 19,397.79 crore in 2024.

For non-life insurance (2022/2024 data), Sadharan Bima Corporation (SBC) holds 11.03%, followed by Green Delta Insurance (9.12%), Reliance Insurance (7.63%), Pioneer Insurance (6.52%), and Pragati Insurance (5.60%).

The sector’s total assets reached Tk 63,629.05 crores by the end of 2022, a 3.34% increase from the previous year. Total investment grew by 1.15% to Tk 46,484.32 crores in 2022. Unaudited data for 35 life insurers shows assets increasing to Tk 48,559.90 crore by 2024.

Penetration and Regional Standing: A Stark Reality

Bangladesh’s Insurance Penetration Rate

Bangladesh’s insurance penetration, measured as premiums as a share of GDP, is remarkably low at around 0.5%. This figure has shown a downward trend since 2009, placing Bangladesh among the lowest globally. Only about 4 out of every 1,000 individuals (0.4%) have life insurance policies, and overall, only about 17 million people are covered out of over 160 million. Bangladesh also has the lowest premium per capita compared to its South Asian counterparts.

Comparative Analysis

Bangladesh’s 0.5% penetration rate is significantly lower than the 3.3% average for emerging markets. Regional comparisons highlight this disparity:

- India: 4.0% penetration with a density of USD 82 in 2022.

- Sri Lanka: 1.2% penetration.

- Pakistan: 0.8% penetration, specifically 0.87% in 2022, with a density of USD 14.

- China: 4% penetration.

Globally, average insurance penetration was 6.7% in 2022. The table below provides a consolidated view:

Table 1: Insurance Penetration and Density: Bangladesh vs. Key Regional Countries (2019-2024)

|

Country |

Latest Insurance Penetration Rate (%) | Latest Insurance Density (USD) |

Year of Data |

| Bangladesh | 0.5 | 9 | 2024/2019 |

| India | 4.0 | 82 | 2022/2019 |

| Sri Lanka | 1.2 | N/A | 2024 |

| Pakistan | 0.87 | 14 | 2022 |

| China | 4.0 | N/A | 2022 |

| Emerging Markets | 3.3 | N/A | 2024 |

| Global Average | 6.7 | N/A | 2022 |

Export to Sheets

Note: Data years may vary slightly based on the latest available information from various sources.

Bangladesh’s low penetration is particularly concerning given its high vulnerability to natural disasters, risking up to 0.8% of its GDP annually, and frequent agricultural shocks. This lack of coverage creates significant economic vulnerability, hindering resilience and fostering dependence on government relief. Increasing insurance penetration, especially in non-life segments, is a national economic imperative for stability and sustainable development.

The Dual Face: Challenges and Constraints

Consumer Trust and Awareness Deficit

A pervasive mistrust, fueled by a lack of consumer awareness and complicated policy terms, is the primary barrier to growth. This leads to a generally negative perception of insurance companies. Religiosity can also negatively impact purchase intention, and many view premiums as an “unnecessary expense” if no claims are made.

This trust deficit is exacerbated by the industry’s failures: low claim settlement rates (34% for life, 10% for non-life in early 2024, 57% overall in 2024), mounting unsettled claims, and instances of fund siphoning. These issues lead to high policy lapses (over 26 lakh policies in 14 years) and a decline in active policies (from 1.12 crore in 2009 to 85.88 lakh in 2023). The mistrust is a self-perpetuating cycle, demanding systemic changes in transparency, ethics, and regulatory enforcement to rebuild confidence.

Operational and Ethical Hurdles

The industry faces a critical shortage of qualified agents and technical employees, particularly in life insurance. Marketing strategies are often ineffective, with inadequate advertising and poor market segmentation. Ethical issues include unhealthy competition and agent malpractice, where benefits are often exaggerated.

The most significant operational failure is the claim settlement crisis. Rates are alarmingly low, with only 34% for life and 10% for non-life insurers in the first nine months of 2024, a sharp decline from 91% in 2018. Unsettled life insurance claims surged over 66% in five years to Q2 2024, totaling Tk 4,615 crore outstanding by end of 2024, with only Tk 635 crore paid. This failure has caused over 26 lakh policies to lapse and a decline in active policies.

Financial instability is compounded by risky capital market investments, low returns, and heavy investment in fixed assets and government securities. Instances of financial misconduct, such as Fareast Islami Life siphoning Tk 2,100 crore and Sikder Insurance investing 73% of assets in a “junk stock,” highlight severe governance issues. Inefficient investment and poor portfolio management jeopardize financial stability.

These interconnected problems—human resources, marketing, ethics, claims, and investment—form a systemic crisis of confidence. Low agent quality and unethical practices lead to misrepresentation, compounded by claim settlement failures, fueling distrust and policy lapses. Financial mismanagement further hinders claim payments. A comprehensive, multi-pronged strategy addressing human resource development, ethical conduct, financial prudence, and streamlined claim processing is essential to break this cycle.

Regulatory and Structural Weaknesses

Historically, the sector has been hindered by legal complexities, bureaucracy, and a lack of transparency. An intensifying liquidity crisis directly contributes to unsettled claims. Delays from Sadharan Bima Corporation (SBC) in settling their mandatory 50% reinsurance share also impede timely policyholder payments.

Widespread corruption and low claim settlements despite IDRA’s existence suggest past regulatory frameworks or their enforcement were inadequate. The SBC delays point to a structural flaw in the reinsurance framework. The absence of specific regulations for Islamic insurance also highlights a broader regulatory gap. Effective, proactive regulation is crucial, not just for penalizing misconduct but for fostering transparency, financial stability, and consumer protection.

Unlocking Potential: Opportunities and Future Possibilities

Economic Tailwinds and Growing Demand

Bangladesh’s robust economic expansion, rising incomes, and increasing GDP create a fertile ground for insurance. The growing middle and affluent classes are expected to increase demand and affordability for insurance products. The industry’s premium is projected to grow at 7.04%, reaching approximately USD 2.2 billion by 2020.

Despite current low penetration, Bangladesh’s economic development inherently generates demand for financial protection. If the industry addresses its weaknesses and rebuilds trust, it can significantly benefit from this organic market expansion. The strong macroeconomic foundation indicates that current challenges are solvable, making the market ripe for substantial growth.

The Digital Leap: Embracing Insurtech

The widespread adoption of digital financial services like bKash offers immense opportunities for digital insurance platforms, enabling reach to remote rural populations without extensive physical infrastructure. Blockchain technology promises enhanced transparency, fraud reduction, and streamlined claim settlements, fostering system-wide trust.

The COVID-19 pandemic accelerated digital adoption. Insurers can leverage this by integrating digital health services like telemedicine, shifting from mere reimbursement providers to holistic health partners. While “poor IT support” is a current issue, the success of “Digital Bangladesh” initiatives suggests a receptive environment for Insurtech. Digitalization can directly address trust issues by making processes transparent and accessible, potentially bypassing traditional points of failure. Strategic Insurtech adoption, combined with ethical reforms, can lead to a more trustworthy, efficient, and inclusive insurance ecosystem.

Product Diversification and Niche Markets

Significant growth potential exists in specialized products like fire, marine, and micro-insurance. Agricultural insurance is particularly promising, given that agriculture employs a third of the population and faces frequent production shocks.

Islamic insurance (Takaful) is a fast-growing segment with substantial prospects, offering Shariah-compliant savings, investment, and charitable opportunities. Diversifying beyond life insurance to address unique societal and economic vulnerabilities—such as agricultural risks, micro-insurance for lower-income groups, and Shariah-compliant products—is crucial for expanding the market and enhancing social resilience.

Strategic Partnerships: The Promise of Bancassurance

The introduction of Bancassurance guidelines in December 2023 by Bangladesh Bank and IDRA is a significant development. This allows banks to use their extensive customer base and networks as distribution channels, leveraging consumer trust in banks (which is generally higher than in insurance companies). Industry experts are optimistic about its potential to drive positive change and enhance financial inclusion.

Bancassurance directly addresses the distribution challenge and the trust deficit by utilizing existing banking infrastructure and credibility. This strategic partnership can accelerate insurance penetration, especially in underserved areas. However, robust regulatory monitoring is needed to prevent risks like transparency issues, commission discrepancies, and misrepresentation.

Customer Behavior and Acceptance: A Deeper Dive

Understanding Purchase Drivers

Research suggests “hope and optimism, not fear – often influence the purchase of insurance” in Bangladesh. Positive consumers are more inclined to buy insurance, expecting honesty and transparency from financial service providers. The pandemic has accelerated digital adoption due to increased focus on health, safety, and convenience, with contactless methods gaining traction.

Service Quality, Employee Behavior, and Complaint Handling

Customer Relationship Management (CRM) is vital for growth. Studies confirm that Service Quality, Employee Behavior, and effective Complaint Handling significantly impact customer satisfaction in Bangladesh’s insurance industry, collectively explaining 48% of the variance.

Customer acceptance is fundamentally driven by trust, hope, and quality of interaction. The pervasive negative perception stems from poor service, unethical practices, and delayed claims. Success hinges on consistently delivering promises, transparent services, and effective customer relationship management. Strategic investment in CRM, ethical agent training, and efficient complaint resolution is crucial for fostering acceptance and retention.

Navigating the Shift from Face-to-Face to Digital Interactions

Traditionally, insurance relied on face-to-face interactions. While the pandemic accelerated digital adoption, the agent relationship remains critical for building confidence. The future likely involves a hybrid model, combining digital efficiency and transparency with personalized human connection. Insurers must leverage technology to enhance, not replace, agent interactions, especially where trust is a major barrier.

Regulatory Reforms and the Path Forward: A New Era of Oversight

The Role of IDRA

The Insurance Development and Regulatory Authority (IDRA), established in 2011, oversees the sector and protects policyholders. IDRA can now settle claims directly (up to Tk 5 lakh for life, Tk 20 lakh for non-life) without court proceedings and mandates companies resolve complaints within 30 days.

In a significant move, IDRA launched special audits into 15 “weakest performing” life insurance companies for 2022-2024 to uncover irregularities, financial distress, delayed claims, declining life funds, falling premiums, rising lapses, and shrinking assets, aiming to identify responsible individuals and take action.

Proposed Insurance Law Amendments (2025)

The government is amending the Insurance Act 2010 to grant IDRA greater authority. Key proposed changes include:

- Enhanced Regulatory Power: IDRA can restructure or dissolve insurer boards if activities harm company or policyholder interests, for up to two years.

- Ownership Limits: No individual, institution, company, or family can hold more than 10% of an insurer’s shares.

- Agent Commissions Restructuring: First-year premiums commission lowered from 35% to 25%, while second-year renewal commissions rise from 10% to 15% (5% for subsequent years), encouraging long-term retention.

- Stronger Enforcement: Regulators can enter and search offices, seize documents, and sell company assets to settle claims. IDRA can ban new policy sales or premium collection for capital shortfalls.

- Increased Penalties: Fines range from Tk 10 lakh to Tk 1 crore, with daily penalties up to Tk 50,000. Violations could also lead to up to two years in prison.

- Improved Governance: Bars pledging assets for director/shareholder loans. Directors require 10 years’ experience and are limited to six-year consecutive terms.

These proposals are seen as crucial for restoring discipline and accountability, similar to Bangladesh Bank’s powers. This marks a critical turning point, with the regulator actively intervening to address systemic issues. The success of these reforms hinges on consistent enforcement and fostering integrity.

Recommendations for Fostering Trust, Good Governance, and Sustainable Growth

Beyond legislative changes, consistent enforcement is paramount. Prudent investment strategies, tighter expense control, and faster, transparent claim settlements are crucial. The industry must focus on innovative marketing, attracting qualified talent, increasing public awareness, adopting modern IT, avoiding harmful competition, and offering diversified products. Developing specific regulations for Islamic insurance is also essential.

Conclusion: A Sector at a Crossroads, Poised for Transformation

Bangladesh’s insurance industry is a paradox: immense untapped potential driven by a dynamic economy, yet constrained by a pervasive trust deficit, operational inefficiencies, and historical governance issues. The alarmingly low penetration, high policy lapses, and unsettled claims highlight the urgent need for fundamental reform.

The path forward is multi-faceted. Leveraging economic growth, embracing Insurtech for efficiency and transparency, diversifying products to meet specific needs (agricultural, micro, Islamic insurance), and fostering strategic partnerships like Bancassurance are key opportunities. Crucially, IDRA’s aggressive regulatory reforms, aimed at enhancing governance, accountability, and consumer protection, are vital for rebuilding trust. The ultimate success hinges on consistent enforcement and fostering a culture of integrity, determining whether Bangladesh’s insurance sector can fulfill its promise as a cornerstone of national economic development and social resilience.

C. Basu.

Bibliography

https://www.theseus.fi/handle/10024/890749

https://www.pwc.com/bd/en/assets/pdfs/research-insights/2019/potential-for-growth.pdf

https://journals.iium.edu.my/ijcsm/index.php/jcsm/article/download/88/44

https://iipseries.org/assets/submission/iip2022C0F776EFBF23B77.pdf

https://www.scirp.org/pdf/jfrm_2410970.pdf

https://www.metlife.com.bd/blog/insurance/bangladesh-insurance-industry-outlook-2021/

https://cc.gov.pk/home/viewpressreleases/613

https://www.thedailystar.net/business/news/idra-opens-special-audits-15-life-insurers-3919716

https://www.scribd.com/document/855840364/IDRA-Act-2010

https://pmc.ncbi.nlm.nih.gov/articles/PMC4912524/

https://www.cribfb.com/journal/index.php/ijibm/article/view/228